Dynamic Electricity Price is coming in Germany, which makes the operation model of Residential ESS and EV charging more diversified

-- Interpretation of market trends at Intersolar Munich 2024

While the European Football Championship (EMC) is in full swing, this year's Intersolar 2024 held at the Munich Exhibition Centre are also welcoming global visitors. In June this year, Munich is of great popularity, even hotter than the weather. And the Messe München Exhibition Centre was also packed with renewable professionals. I was also with honour to be presented at this year's Intersolar Munich exhibition and visited a round of European clients and partners right after the show. Since recently is the vacation period in Europe, I would like to take a break and share some thoughts collected from Intersolar Munich 2024 and PV magazine regarding the PV and energy storage regarding German market. Should we get anything wrong or inappropriate, please contact me and correct me immediately.

In summary, the product or market trends in the German market are listed as follows:

· Dynamic electricity prices are being introduced. Dynamic electricity prices are introducing to the German market, and the future operation modes of residential solar batteries and electric vehicle charging will be more diversified and intelligent. It is said, by 2025, dynamic electricity prices may be mandatory for power operators with users exceeding a certain size in Germany, which will of course involve some infrastructure upgrades, such as retrofitting current meters with smart meters etc. As a result, the negative electricity price issues partially caused by intermittent energy generation and fluctuating electricity demand should be alleviated to a certain extent;

· Trends of PV and energy storage integration and, cost reduction of key components upstream have benefited downwards end owners. The payback of Residential and C&I solar battery is much better. Especially the C&I solar battery, unlike choosing which residential solar battery is still influenced by private customer preferences and has some consumer goods characteristics, the cost performance or return-on-investment ratio has a decisive influence on if to install a C&I system or not. As a typical toB product, C&I solar storage products are very hot on the market in 2024, and C&I outdoor cabinets or containers can be seen almost everywhere in the hall. Although the competition is a little bit fierce, the trend of market scaling can be felt when product standardization and cost reach the limits of investment feasibility;

· All-in-one PV storage design and higher power three-phase hybrid inverters. The residential solar battery system is still following the trend of all-in-one integrated design; besides, in the past 2 years, mainstream manufacturers of PV and battery inverters have launched to the market a series of around 15kW (12 /15/18/20/25/30kW etc.)3-phase solar battery hybrid inverters, or completed the grid connection certifications of this series for better applications in Germany or other EU countries;

· PV module prices continue to fall. Recently, solar module prices have not stagnated as expected, but have fallen slightly again. The key cause may still be the periodic imbalance between supply and demand. In the past 2 years, favourable policies, raising electricity prices in Europe, and the influx of capital hot money at manufacturing side have led to the flourishing of the PV industry. Some players have implemented the competitive strategy of "scale manufacturing to achieve cost competitive advantages and then grasp market share". However, now that electricity prices have fallen, demand growth has not been as fast as expected, and the new and old market-dominated technology routes have switched, the industry has too much PV module production capacity and inventory. When the old and new production capacity are in transition, in order to utilize the excess capacity and clear out the inventory, in this round of industry reshuffle, all players can only compete on price to reduce financial losses for survival, and then seek growth;

· The procedures for balcony solar storage are more simplified. Speaking of the micro-inverter-based balcony solar storage, as the existing string solar battery has certain requirements on installation space, initial capital investment, basic inputs for installation, commissioning and grid connection registration etc., which limit the installation of many apartment users. Balcony solar storage will be a good choice for many apartment users (most of the German still lives in apartments). With the completion of Germany's balcony solar storage legislation, the more simplified for the installation, the large-scale cost reduction of and the iterative development of micro-inverters technology, the scale commercialization process may be accelerated, occupying a certain proportion of the household solar storage market.

1. Dynamic Electricity Price is coming in Germany, which makes the operation models of Residential ESS and EV charging more diversified

Germany is gradually changing from the previous fixed electricity price (Fix Preis) to the dynamic electricity price (Dynamische Tarif) daily ahead or hourly ahead, and the transition may be gradually completed in 2025. I believe everyone can feel that dynamic electricity prices are entering the market from this year's Intersolar Munich exhibition. But how can consumers take advantage of the dynamic prices to lower their energy bills?

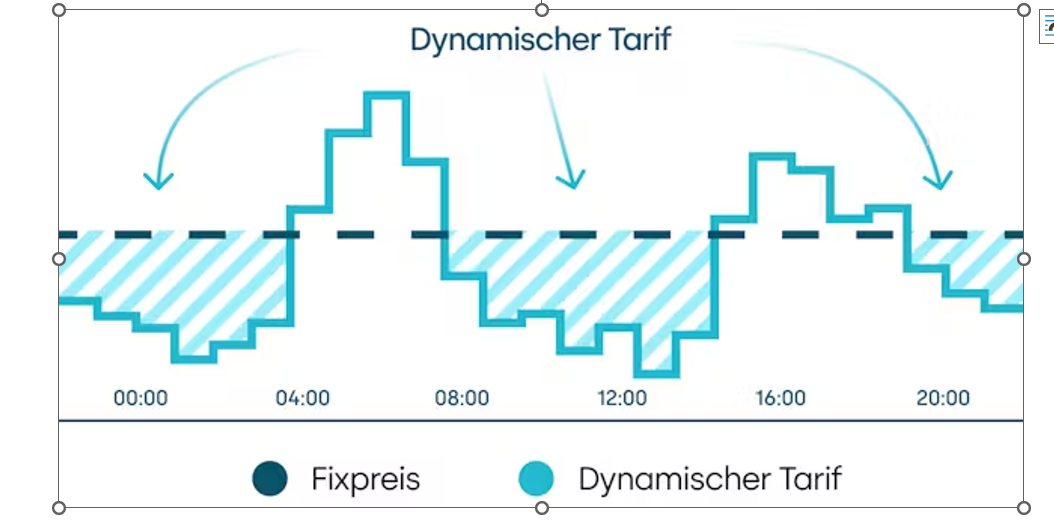

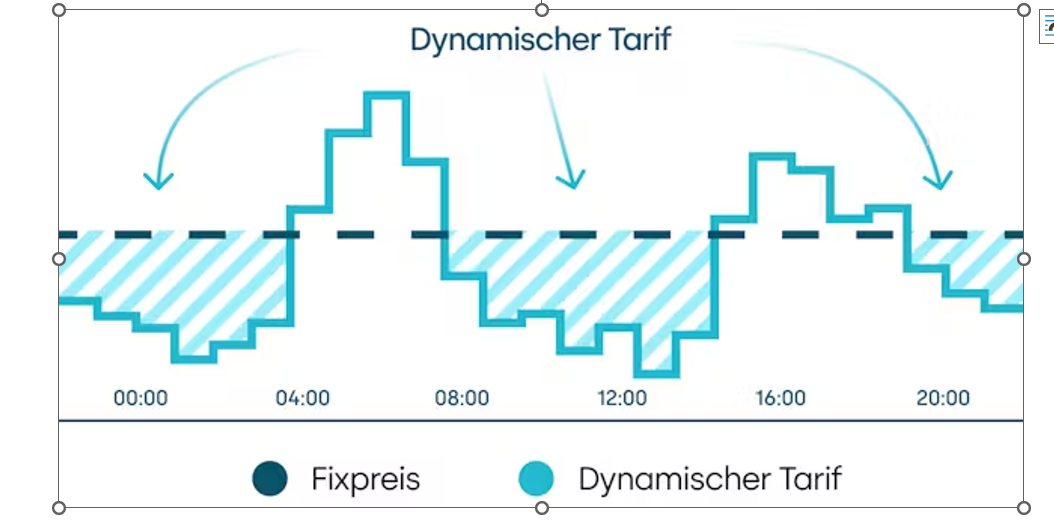

(Source: tibber.com. About Dynamic electricity price: dynamische Stromtarife in German. Under this mechanism, electricity in Germany will be delivered at the official wholesale price of the European day-ahead or hour-ahead market. Therefore, prices fluctuate every hour - depending on supply and demand. For example, at the end of the workday, when many people are cooking or completing other housework, electricity demand is at its peak and electricity prices are usually high. In the midnight, when most people fall asleep, prices fall again as demand is low. This is an electricity price mechanism similar to time-of-use electricity prices, but with even larger flexibility. With dynamic electricity prices, consumers can directly benefit from such ups and downs. This is because it is an electricity price that allows users to directly align their electricity consumption behaviours with changes in electricity prices in the electricity market. High-power intensive electricity consumption, such as electric car charging, laundry, etc., can be specifically shifted to lower-priced hours.)

Advantages of dynamic electricity prices

Dynamic electricity prices seem to gain multiple advantages, including the following:

• For private households, intensive electricity consumption (such as EV charging, laundry, etc.) is shifted to lower-priced hours, which is expected to save up to 30% of household energy bills;

• For governments or power network operators, it can ease the grid-connection issues of renewables and lower the influence of negative electricity prices;

• For upstream and downstream players in the household PV storage industry, the system operation is more intelligent, and the operation and revenue models are more diversified;

• For upstream and downstream players of distributed PV, the implementation of dynamic electricity prices may alleviate the problem of difficulty in connecting renewable to the grid to a certain extent;

• For upstream and downstream players in the EV industry, it is usually cheaper to charge EV at night, which can greatly speed up the electrification of German transportation compared to the previous fixed electricity price.

With battery storage, you can maximize the energy generated from your PV system. Nowadays, with more intelligent EMS, the battery storage can do more than maximizing self-use. Battery storage can be charged during lower-priced hours such as midnight, the charging power source of battery storage during winter will not be limited to only PV, but can also include public grid. This could make the residential solar storage operates in a more attractive mode and benefits all end customers.

Of course, for residential solar battery, the mechanism of dynamic electricity price might also bring impact on the other side. Imagine that, if with the dynamic electricity price, the distributed PV or battery storage is easily to be deployed and grid-connected, then as it has much less average deployment cost comparing with residential solar batteries; and technology like V2G is of higher payback as energy storage is only a side function besides transportation, then in a certain period or to a certain degree, the demand for stationary household solar battery might be decreased. Of course, this could be a long-term, dynamic balance of: cost of non-residential PV and storage, multifunctional feasibility of EV motive batteries, cost influences on user electricity consumption habits and the cost of stationary residential solar battery.

Whatever, with the dynamic electricity prices, it is usually cheaper to charge an electric car at night, which should be a great favor for the transportation electrification in Germany.

How can consumers take advantage of the dynamic prices to lower their energy bills?

Smart home and smart metering technologies can help monitor or control the electricity consumption automatically, so as to minimize the electricity costs. With smarter energy management systems (EMS) and electricity meters, it will be possible to charge electric vehicles and charge home battery storage from the grid overnight, thereby optimizing household energy consumption.

2. C&I solar battery--the new market hots and cost down of upstream components benefits downwards

Cost down of key systems components upstream such as PV cells and battery cells have benefited downwards end owners. The payback of residential and C&I solar battery is much better. Especially the C&I solar battery, unlike choosing which residential solar battery is still influenced by customer preferences as residential PV ESS has the consumer goods characteristics, the cost performance or ROI ratio has a decisive influence on if to install a C&I system or not. As a typical toB product, C&I solar batteries is quite a market hot in 2024, and C&I outdoor cabinets or containers can be seen almost everywhere in the exhibition center, and exhibitors are promoting them with discounts. Although the competition is a little bit fierce, the trend of market scaling can be felt when product standardization and cost reach the limits of investment feasibility.

As C&I solar batteries become more commercialized, engineers and installers are gradually becoming more familiar with them

With the market dominance of standard products such as 215kWh outdoor cabinet and 372kWh battery cluster, gradually the C&I solar battery systems are more suitable for project planning through planning software, procurement of core components through distribution network and installation by experienced engineering installation personnel. Although the C&I solar battery is slightly more complicated than residential solar battery, it is already feasible to promote and penetrate through distribution network, just like residential solar batteries in the past.

Trends of C&I solar battery: more standardized products and decreasing costs

The C&I solar battery market is quite hot recently, and the main driving force could be the more standardized products and decreasing component costs. At present, many medium and large-scale solar storage projects can theoretically be paid back within 3 to 7 years.

· Cost reduction on the supply chain. Lithium-ion battery cells and solar cells are main cost components of solar battery systems. Over the past 2 years, for batteries, the cost of raw materials has dropped and the energy density has increased a lot, resulting in a significant drop in battery cell costs. For solar panels, decreasing raw materials costs, larger cell size and fiercer competition, which has also led to a 50% drop in the average cost of PV modules. Furthermore, the standardization of C&I solar battery systems has also contributed to a further reduction in system costs.

· Products are more standardized. With the wide application of 280Ah prismatic cells pioneered by CATL and liquid-cooling technology in the field of medium and large-scale energy storage, the standardized 215kWh liquid-cooled outdoor cabinets or 372kWh liquid-cooled battery cluster have a dominant trend on the market. Also, most large-scale energy storage solutions mainly use 3.5~5.5MWh 20GP liquid-cooled container integrated by 372kWh battery cluster or its derivatives. The more standardized and safer of systems has greatly improved the transparency of project and reduced the project risks of project developers, EPCs, investors and project owners etc., which might bring a new boom to the industry.

Solar-storage integration: EPCs and project developers are exploring and implementing medium and large-scale solar-storage integrated projects

Of course, project delivery through EPC and project developers is still the mainstream channel for medium and large-scale photovoltaic storage products.

In the past, at Intersolar, EPCs and project developers mostly discussed the demands for PV power plants, wind power generator or front-of-the-meter grid energy storage projects, while the demand for photovoltaic-storage integration projects accounted for only a small number. However, it can be felt that in the past two years, many EPCs and project developers have been discussing and executing medium- and large-scale photovoltaic-storage projects.

In addition, for the medium and large-scale photovoltaic and energy storage markets, dynamic electricity prices may further stimulate the emergence of more renewable power suppliers, which may realize electricity arbitrage by building some PV and energy storage integrated power stations.

Germany's innovative tender: all bids are related to PV-storage integration systems

According to a report on PV Magazine in July, Germany’s latest round of innovative tenders was easily signed. The Federal Electricity Authority received a total of 48 bids for a total capacity of 564MW. According to the report, all bids are related to the integration of photovoltaic and energy storage systems. The trend of photovoltaic and storage integration is becoming increasingly significant.